My MP is keen that we should vote to leave the EU. He replied to me in a letter ‘This means that we currently send £50 million a day to the European union. If the UK was not in the EU, we could spend this money on farming and our public services, as we see fit, rather than unelected Brussels bureaucrats.‘

My MP is keen that we should vote to leave the EU. He replied to me in a letter ‘This means that we currently send £50 million a day to the European union. If the UK was not in the EU, we could spend this money on farming and our public services, as we see fit, rather than unelected Brussels bureaucrats.‘

Well let’s just pass over the fact that we wouldn’t want bureaucrats to be elected – that’s why we have politicians. Why would you want the civil service to be elected? And we’ll pass over the fact that ‘our’ money goes to other people in the EU, ideally the more needy, and not primarily to the EU civil service. And let’s just pass over the fact that we are one of the richest countries in the EU and the whole point of being in a bigger group is that the rich pay more for the privilege than the poor – not something that I would necessarily expect my Conservative MP to have fully internalised.

But the idea that we would spend more of ‘our’ money on farming is a very odd one.

I was talking to another of Mr Pursglove’s constituents a while ago – a farmer – who told me that he would definitely be voting to Remain in the EU and not to Leave. His reason? ‘I don’t trust British governments but I know the French and German governments will be fighting for farmers in the EU even if the UK might not.‘.

He’s right. if the UK left the EU I’m sure that we would see a rapid and inexorable erosion of farm payments as the urban voters asked for their money back.

![Richard Webb [CC-BY-SA-2.0 (http://creativecommons.org/licenses/by-sa/2.0)], via Wikimedia Commons](https://markavery.info/wp-content/uploads/2013/07/Wheat_field_-_geograph.org_.uk_-_216367-150x150.jpg)

Since agricultural payments are mostly just unencumbered income support for farmers, including the Duke of Westminster and the National Trust, any government having to defend them itself would struggle. We could increase income support to the Duke of Westminster and the National Trust, but I’m guessing that we wouldn’t.

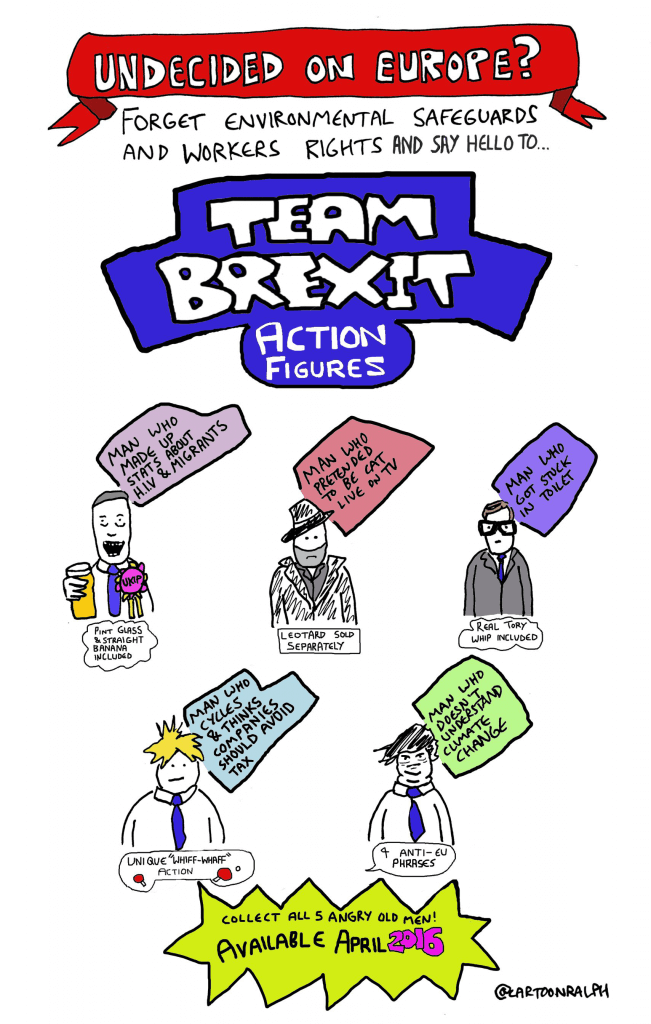

We could do many brilliant things if we left the EU – but I’m betting on the fact that we wouldn’t – instead George Osborne, Owen Paterson, Michael Gove and Boris Johnson would do some foolish things.

[registration_form]

No real comment to make other than well said, Mark!

I don’t usually agree with everything you post Mark, but you’re bang on the money here. And you haven’t mentioned environmental benefits of Bremain. And I sometimes think that unelected bureaucrats are preferable to the likes of Gove,IDS, Boris, etc etc.

I tend to agree with your farmer friend.

Although I don’t think the subsidy system helps farming or the environment in most cases.

I see single farm payment in the same light as I see working tax credits.

(Another benefit/allowance many farmers have to rely on).

Working tax credits not only subsidise the individual but aids their employer to pay them less.

SFP helps retailers keep food prices low which in my humble opinion is a bad thing.

Low cost food encourages low cost production, which drives environmental degredation & poor animal welfare through intensification.

Money needs to be spent educating the consumer as to why they should be eating better quality & higher priced food.

Steve – thank you for your comment and welcome!

Some good points Steve, but the idea that decoupled SFP or BPS as its now called encourages retailers keep food prices low is a myth that doesn’t stand up to any degree of scrutiny. UK farmers are essentially producing soft commodities for a global market place where supply and demand is the biggest factor in determining farm gate value. Just look at what is currently happening in the milk sector. BPS essentially enables (just about) UK farmers to produce soft commodities for the global market, produced to European food safety, animal welfare and environmental standards.

“a myth”

Yeah but, as income support to some extent the BPS allows farmers to keep their noses above water and survive to be exploited next year. But I agree about the commodity market angle.

“working tax credits.”

ah yes – several multi millionaire farmers round here owning 1,000 acres or so are so desperately impoverished that they have to claim tax credits to support their children.

While other people who have very little capital subsidise them with their taxes….

Hurrah for accountants!

“Working tax credits not only subsidise the individual but aids their employer to pay them less”.

Especially ironic when they are their own employees/employers!

Lets face it our politicians will do foolish things in or out and if we remain in the EU our partners and the Eurocrats will continue to do foolish things too. We can kick out the former but not the latter.

I think a PIP scheme for farmers as a replacement for the current arrangements would be great. Most would get nowt.

Unfortunately the way our electoral and political system works, it’s actually not very easy to kick out our politicians or indeed for different voices to be heard. We’re locked into a two-party system which on the one hand is ostensibly adversarial but on the other deeply small ‘c’ conservative in so far as new or different ideas are able to take root and flourish from either side. And all supported by an unelected, bloated and deeply undemocratic upper house.

Europe needs reform, but so do our political and democratic system and structures. And in the absence of the latter and given the history of the UK’s unwillingness to put the overall wellbeing of its people over the individual rights of a few, Europe provides a backstop that in my view we really need.

Many of the active lowland farmers I have dealings with are quite open to the idea of scrapping all direct subsidy payments, but, quite rightly, they know that this would be economic suicide if this was a decision that the UK took unilaterally. Ending support payments is only feasible if it’s a decision taken across the EU and to an extent North America.

In the event of Brexit, I can’t see even neo-libs like Osbourne, Johnson or Gove completely doing away with direct support payments, my hunch is that they would remain but be slightly reduced from the current level. Part of the deal would be that Cross Compliance would be completely scrapped, this would sell the deal to the farming lobby. I think we would still see some form of agri-environment support – after all those grouse moors can’t be expected to fund themselves you know. . .

Given how incompetently DEFRA manages the single farm payment system when under threat of fines for late and incorrect payments by the EU, can you imagine how bad they would be if there was nobody holding them to account?

On another theme, one of my favourite farming families is being forced off the land because, as tenants, their landlord has doubled their ground rent for next year. It is one of the best managed farms in Wiltshire but, since the Crown Estate sold the land off to a private enterprise, unfettered greed has taken over from good husbandry and I shudder to think what will happen under the new regime. Of course, they get no help from the NFU. Small farmers need to set up their own union, because the NFU is ONLY interested in the big landowners and politicians.

On past performance, the likelihood that the gentlemen in question will do foolish things regardless of Brexit, Bremain, Brindecision or Bromance, seems rather high. That’s clearly not limited to persons belonging to the set represented by their party or politicians as a group, however.

But looking ahead, chance of the next budget failing to take proper account of global climate change, renewable energy/energy efficiency measures, air pollution levels or opportunities to make the most of natural capital also rather high too. Not covered in Gideon’s bible it seems. Meanwhile Sheffield City Council will struggle bravely on against those nay-sayers perpetrating claims that a city landscape littered with mature trees is a good thing.

Even Defra’s Unified Hedgehog Index as to the state of the natural environment (saves messing about with counting all those different farmland birds) seems set to plummet yet further despite attempts to encourage us all to care for our hedgehogs.

One wonders what a realistic budget exhibiting shoots of ‘green-consciousness’ might have contained. Probably nothing favoured by the illustrated gentlemen.

Maybe whether ‘spending money on farming’ is a good or a bad thing depends how it is spent. Farming is a broad term. If money is spent to try and encourage farming to be more environmentally sensitive AND if it achieves that it might be a good thing. Eg encouraging late cut haymaking over silage.

Farmers are businessmen and therefore inevitably motivated by economic factors in how they manage the land. Trying to tilt the balance in the favour of the environment might be for the good.

That’s not to say such a tilt would result from a brexit though.

“agricultural payments are mostly just unencumbered income support for farmers”

Maybe in the aggregate, but way out ahead individually is Mr Cube – according to this:

http://farmsubsidy.openspending.org/GB/browse/?page=1&start=594270083.69-GB47951

“agricultural payments are mostly just unencumbered income support for farmers”

Maybe collectively, but way out ahead individually is Mr Cube – according to this:

http://farmsubsidy.openspending.org/GB/browse/?page=1&start=594270083.69-GB47951

Duh

It is a bit much to assume that farmers are the only beneficiaries of government assistance. Public spending per UK household is about £29,000 per annum. If a household’s total annual tax payment is more than £29,000 then they are a contributor and if it is less than £29,000 then they receive more every year than they pay into the system. Why single out farmers?

So presumably farmers get their £29,000 share of public spending to start with, then their subsidies on top. Double bubble. Very nice.

At one time you could go online and see exactly how much subsidy each farm business received each year, but the farmers put a stop to that. The EU was supposed to be tweeking the system so that it could be reinstated and be ECHR compliant but it hasn’t happened yet.

What was interesting about the figures was how ill divided the subsidy payments were. The least well off got the lowest payments and the wealthiest got the highest. Hence the demand for secrecy I guess.

Some farmers will pay far more in tax than they receive in subsidies and some farmers will pay no tax at all.

It is still possible to find out the details of subsidy payments (at least up until 2014).

‘Some farmers will pay far more in tax than they receive in subsidies’

Very few – possibly less than 1-2%. Some pig and poultry units, but then what are import tariffs and import quota’s if they are not a subsidy?

Furthermore, most farm business pay tax on profit remaining after the mortgage/rent, council tax, heating, electricity, water, telephone, broadband etc has been paid. That’s a luxury Joe Public doesn’t enjoy.

Is your estimate of one or two per cent derived from any published source? It might be ten per cent or twenty per cent. I don’t think anyone knows the true figure.

Self employed Joe Public certainly has the right to claim the expenses you list.

No – just an educated guess.

The only two sectors that could conceivably throw up a meaningful number of farms that pay more in tax than they receive in subsidy are pigs and poultry. There are around 1700 specialist pig units and around 2500 specialist poultry units in the UK. Combined they equate to 1.981% of the UK’s 212,000 farming businesses.

Seems I’d probably overestimated then as many pig units won’t have paid much tax at all in recent years.

You’ll have to enlighten me as to the other industries where the hmrc allow mortgage and household rent as allowable expenses.

BIM47820

The interest element of a mortgage payment, usually calculated pro-rata to cover perhaps one or two rooms isn’t quite as attractive as having the full mortgage payment (interest and capital) as an allowable expense.

http://cap-payments.defra.gov.uk/

2015 payments have not been updated due to the general shambles the RPA is in.

Of course those who want us to vote to remain in the EU include a man alleged to have had intimate relations with a pigs head and one who lied to us about tuition fees.

Maybe you could check but I do not believe the EU has ever had a signed off set of audited accounts. So there will be no mention of the “c” word here then.

Whether you think we should leave or stay in EU, I would really recommend reading ‘Did David Hasselhof End the Cold War?’ By Emma Hartley. Fantastic insight into Europe via 50 articles, l learnt about everything from the economic theory behind agricultural subsidies (very useful indeed) to Albanian blood feuds from it. One of the best written, enjoyable and educational books I have ever had my big nose in. Nearly forgot it also talks about the Maltese bird slaughter.

Your MP really is a star ! He clearly is quite unaware of the fact that about half the total EU budget goes to farmers – much of the money we send to Brussells coming back as farm subsidies.

But it is fascinating that farming is hardly mentioned in Brexit – in fact many of the key anti EU MPs represent farming constituencies (eg Owen Paterson) – and, because it is EU co funded, agricultural payments have completely avoided austerity cuts.

However, it is ridiculous to start speculating on minor adjustments after Brexit. they won’t be minor – they will be massive. For starters, will Government use money coming back from Brussells to replace the roughly 50% EU co-funding, or will they simply use it for something else completely ? Almost certainly the latter. And whatever promises are made now, it is almost certain that farming will lose out when the first economic crisis hits – and it won’t be long in coming.

Brussells? Is that where the sproutts come from?